This year, New Delhi experienced unprecedented high temperatures, yet beer, a favorite summer drink, has struggled to meet demand. Despite the scorching heat, many popular beer brands are missing from store shelves, and numerous liquor shops lack the capability to sell chilled beer. Industry estimates indicate that while beer sales have grown in other states, they have slightly declined in the national capital for the second consecutive year.

Comparative Beer Sales Data

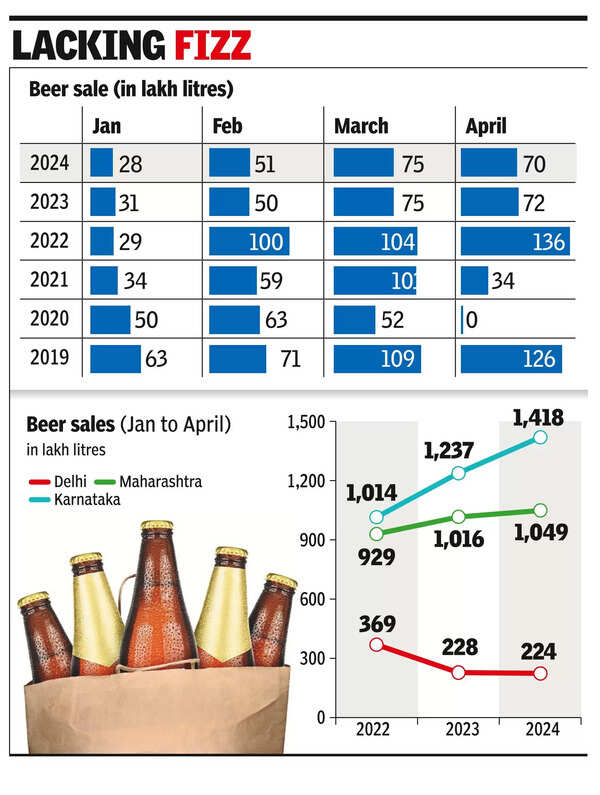

Delhi sold 224 lakh liters of beer through its network of nearly 660 liquor stores and over 950 hotels, bars, and restaurants by April 30 this year. This figure is down from 228 lakh liters during the same period in 2023 and significantly lower than the 369 lakh liters sold in 2022. The spike in 2022 sales was attributed to a new excise policy and retail schemes offering discounts on various alcoholic beverages.

In contrast, Karnataka and Maharashtra sold 1,418 lakh liters and 1,049 lakh liters of beer, respectively, between January and April this year. This marks an increase from 1,237 lakh liters and 1,016 lakh liters sold in 2023. Although Delhi is smaller in size and population and has fewer liquor shops and bars compared to these states, the numbers highlight the growth in beer sales elsewhere.

Impact of Supply Issues and Retail Challenges

Beer accounts for over one-third of the total liquor volume sold in stores during peak summer. Industry insiders believe the potential for higher sales in Delhi exists, given the city’s intense heat and high humidity levels for nearly half the year. However, the poor availability of popular brands has driven residents near the Haryana and Uttar Pradesh borders to cross state lines to purchase beer. As a result, neighboring towns have seen a 15-20% annual increase in beer sales, while Delhi’s sales have declined.

Vinod Giri, Director General-Designate of the Brewers Association of India, noted that while demand for beer surged in Delhi’s summer heat, supply did not keep pace, leading to a dip in sales below 2023 levels. He pointed out that a popular beer brand was unavailable in the market, and other suppliers struggled to fill the gap. Additionally, the low maximum retail prices allowed in Delhi result in negative margins for most brands, reducing the incentive to supply the city when demand is high nationwide.

Challenges and Potential Solutions

The number of retail shops in Delhi is insufficient, and chiller penetration remains below 50%, significantly impacting beer sales. Giri suggested that to improve the situation, the number of beer shops needs to double, and companies should be allowed to set more realistic and favorable prices. Without these changes, the same issues will recur each summer.

State governments where breweries are located often ask companies to prioritize local supply during peak summer rather than sending stock to other states and cities, further limiting Delhi’s beer availability.

Official Statements and Market Trends

A senior Delhi excise department official acknowledged the availability issue of a popular beer brand this season. However, another official claimed there was no overall shortage of beer in the city, noting that several new brands are now available, which customers are trying out.

With temperatures soaring in May, liquor companies are optimistic about improved sales and better returns. A spokesperson for AB InBev India, a major player in the beer industry, mentioned an increasing trend of consumers purchasing beer cans for in-home consumption due to their ease of use and portability.

Another industry insider noted that breweries are hopeful of better sales and returns as customers slowly shift to premium brands, driving demand for higher-quality beers. The rise of social gatherings has also boosted the popularity of draught beer, leading to increased demand and efforts to ensure a steady supply.

In summary, while Delhi’s beer sales have faced challenges due to supply issues and retail limitations, there is cautious optimism for improvement as the market adapts to changing consumer preferences and increasing temperatures.